If you have a claim with Travelers Insurance, you might be curious how the claims process works and what average Travelers Insurance settlement amounts are. Pursuing a personal injury claim on your own through a third-party insurance company can be a stressful and frustrating process.

Fortunately, the Florida personal injury lawyers near you at Abrahamson & Uiterwyk have developed an excellent reputation for successfully helping Florida clients get the compensation they deserve. We can help you when you need to open a Travelers Insurance dispute claim.

What Is the Average Travelers Insurance Settlement Amount?

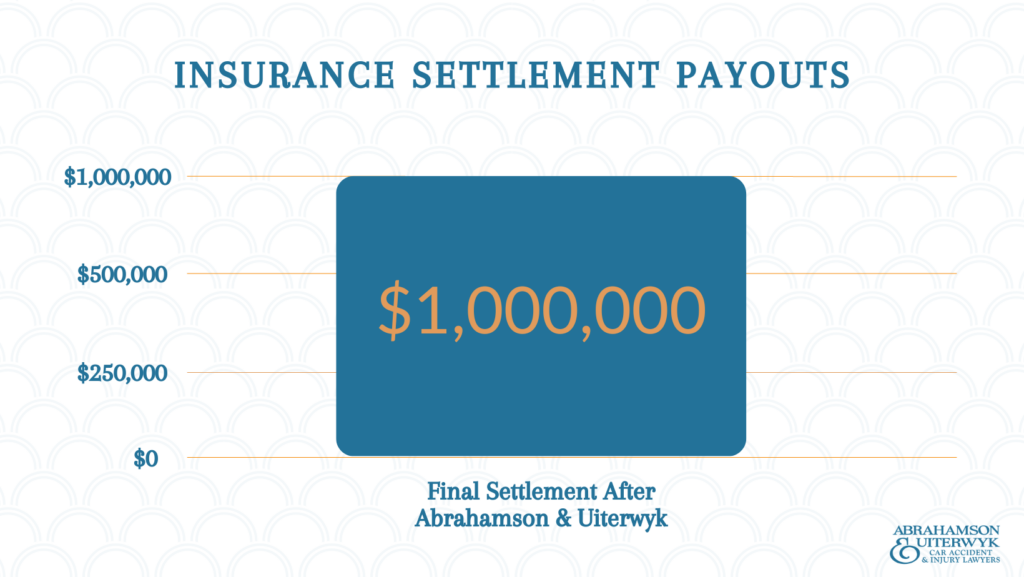

All claims are different, and many factors can influence your potential Travelers Insurance payout value. Some of the most significant factors that impact your claim’s value include injury type and severity, liability, your total amount of damages, and the available insurance policy limits. According to the examples of insurance settlement payouts on this page, the typical Florida insurance settlement payout is anywhere from $500,000 to $1,000,000. While these are not specific to Travelers Insurance, insurance settlement amounts depend greatly on the unique circumstances of each case which is why there is no accurate average insurance settlement payout.

Extent of Injury

Someone with a spinal cord injury and paralysis will have a higher claim value when compared to someone who sustained soft tissue injuries that healed within three months. Even similar injuries can have significantly different values. For example, someone with a broken leg that healed within three months with no residual pain complaints would likely have a lower claim value than someone who is permanently disabled due to a fractured leg. Trimalleolar ankle fracture settlements may result in higher claim values, as these injuries often require surgery, extensive rehabilitation, and may lead to long-term complications or chronic pain.

Comparative Fault

Liability also plays a significant role in determining settlement value. Florida is a modified comparative negligence state. This means that if you are found to be no more than 50% at fault for the accident, your recovery is reduced by the same proportion as your percentage of fault. As an example, if you are found to be 20% at fault in an accident, you may still recover 80% of your damages in a lawsuit. If, however, your percentage of fault is found to be more than 50%, you are barred from any recovery under the law.

Policy Limits

Available policy limits can also impact your settlement value. Two cases can be worth similar amounts, but available insurance can affect how much you receive. Consider a situation where you have $200,000 in damages. If the at-fault party only has $50,000 in insurance coverage, you won’t be able to collect the total $200,000 unless you sue the defendant directly or have other potential avenues of recovery. On the other hand, if the defendant has $500,000 in available coverage, you could receive the total value of your claim from the defendant’s insurance company.

Examples of Insurance Settlement Payouts

$500,000 / Motor Vehicle Accident / Fractured Collarbone / Zephyrhills, FL

67-year old female was injured when the defendant lost control and struck the vehicle that the client was a passenger in. As a result of the crash, the client sustained a fractured collarbone and neck injuries. We obtained the maximum available insurance proceeds on behalf of our client in this case.

$600,000 / Motor Vehicle Accident / Neck and Knee / Homosassa, FL

38-year old female was injured when the defendant pulled out of a parking lot and struck the client’s vehicle. As a result of the crash, the client sustained a herniated in her neck requiring surgery and a damaged ligament in her knee. We obtained the maximum available insurance proceeds on behalf of our client in this case.

$775,000 / Motor Vehicle Accident / Wrongful Death / Hernando Co.

This unfortunate accident occurred on Cortez Boulevard in Brookville, Florida at an intersection. The defendant driver, who had a solid green light, failed to yield the right of way to the vehicle our client was driving by turning left directly into our client’s path and causing a massive impact.

Our client was rushed to the hospital with multiple injuries including broken vertebrae and a fractured pelvis. Tragically, our client did not survive his injuries and passed away shortly after the accident. His son was appointed personal representative of his estate so that a wrongful death claim could be presented.

In addition to our client, we also represented his wife who sustained significant injuries. Between the two cases, we were able to secure a recovery of $1,550,000.00 which was divided evenly between the claims. This was the limit of all available insurance policies.

$1,008,258 / Motor Vehicle Accident / Manatee County, FL

Our clients, husband and wife, were involved in a serious accident where the defendant ran a red light. He suffered back and shoulder injuries, and she had an injury to her neck. This settlement represented the maximum amount of insurance coverage available.

How Long Will My Claim Take?

How long it takes your case to resolve can also vary. Some claims might settle right away, while others can take several years. Claims that resolve quickly often involve significant injuries and low insurance policy limits. If it’s evident that the other party is at fault and your financial losses exceed the available bodily injury insurance, the adjuster may offer to pay the policy limits early in the process.

However, be cautious of insurance adjusters who make early settlement offers. The adjuster knows your claim is worth more in many cases but wants to resolve early to cap their exposure. They hope by offering you some money now, you will settle before the actual value of your claim is revealed.

If Travelers denies your claim for lack of coverage or liability, you will need to file a lawsuit. Claims that enter the litigation phase may take considerably longer to resolve. It could be several years at that point before your case goes to trial or there are further negotiation talks. This isn’t just the case for Travelers Insurance, learn more about Farmers insurance lawsuits as well as other insurance disputes.

Tips for Dealing with Travelers Insurance

If you are unrepresented, dealing with an insurance company can be daunting. You want to keep some helpful tips in mind when dealing with Travelers to improve your chances at a better settlement.

Do Not Give the Adjuster a Recorded Statement

Whenever you open a claim, the insurance company will request a recorded statement from you. This request may seem harmless, and the adjuster will assure you that it is standard practice in the claims process. However, that statement could harm your case. The adjuster is looking for you to say anything that gives them the chance to place liability on you or reduce your claim value.

Be cautious if you are supposed to meet with a claims representative in person as well. You are not obligated to give a recorded statement, and most personal injury attorneys will advise against it. When an attorney represents you, the insurance company cannot speak with you directly. Instead, all communication is between the adjuster and your attorney.

Do Not Sign a Release

You should not accept a settlement offer or sign a release of all claims without first speaking to a Tampa personal injury attorney. Once you sign a release or cash a settlement check, you extinguish the right to any future claims. If you are not done with your medical treatment and find out after signing a release that you need additional surgery, you cannot demand further compensation. That is why you should have a clear picture of your total claim value before engaging in negotiation talks or agreeing to settle.

Retain an Attorney

The best tip for dealing with Travelers or any other insurance company is to retain an experienced personal injury attorney to represent you. Attorneys, especially those who have prior experience negotiating with Travelers Insurance, can benefit you in these situations. Your attorney for insurance issues will protect your rights, gather evidence, and negotiate directly with the Travelers representative. At Abrahamson & Uiterwyk, we have years of experience resolving personal injury insurance claims with insurance companies, including Travelers.

What to Do If Travelers Contacts You

If Travelers Insurance contacts you, it’s important you know your rights. You are not legally obligated to talk to the other party’s insurance company. As the third-party insurance company, Travelers does not have your best interests in mind. Instead, their priority is protecting their insured. That means the claims adjuster will be looking for any way to reduce their exposure.

Dealing with the insurance company on your own can seem daunting. That is one reason why working with an experienced Tampa personal injury lawyer is recommended. When one of our attorneys represents you, we will handle all communication with the other party’s insurance company. Please do not feel pressured to accept any settlement offer they extend either. You have the right to have the offer reviewed by one of our lawyers.

Should I Expect Travelers to Make a Fair Settlement Offer?

Unfortunately, you cannot expect that Travelers Insurance—or any other insurance company—will offer you a fair amount for your injury claim. Insurance adjusters for the at-fault party have one priority in a personal injury claim, and that’s to reduce the insurance company’s exposure. Their goal is to place as much liability on you as possible or reduce your claim value to save money.

How to Contact Travelers in Florida

Travelers Insurance has a longstanding commitment to working with independent agents. You should contact your agent prior to attempting to contact Travelers Insurance directly. Travelers does offer a claim center section on their website if you need to initiate a new claim. You can report a claim directly through your MyTravelers account if you have one. You can also proceed to report a claim as a “guest” without logging in.

To contact Travelers over the phone, call 1-800-252-4633 24 hours a day, seven days a week.

How to Tell If You Need an Injury Lawyer?

While you can choose to pursue a personal injury claim through Travelers, it’s best to contact an injury attorney before settlement. It’s never too early to reach out to our legal team. The sooner you contact us, the sooner we can start working on your case.

If you’re dealing with injuries such as a bimalleolar fracture, understanding the bimalleolar fracture settlement value is crucial to ensuring you receive fair compensation. We offer free initial consultations, so you have nothing to lose by meeting with us. We won’t take any fees or costs unless we successfully recover compensation on your behalf. Contact our nearby office today to learn more about how we can help you pursue a personal injury claim with Travelers Insurance.

See What Our Clients Have To Say!

“The team was extremely helpful and made the whole process smooth from beginning to end. Justin is a great attorney and I really appreciate all their help with my case cant recommend them enough!”

Kevin W.

Rating 5/5 ⭐⭐⭐⭐⭐

See our 4.9 rating and read more of our 344 reviews on Google!